Posts

Remember, internet casino bonuses are designed to give more financing, possibilities to speak about the brand new online game, and you will increased probability of effective. Take advantage of the adventure sensibly, to make the most of your own fantastic also provides readily available this season. Converting on-line casino incentives for the real cash requires appointment the newest betting conditions set by the local casino. Once you understand these terms and conditions is important to own improving the bonuses’ value.

Factors While using Spend by Mobile phone Expenses Ports

Thus giving you satisfaction if you are viewing your chosen on line ports. Shell out because of the mobile slots are those in which you is put and you will withdraw with your smartphone. Very first, you will want to choose a wages-by-cellular casino you to definitely aids this. Just after choosing a gambling establishment, you will have to perform a merchant account with them.

1. BetMGM Online casino – Finest Put Matches Overall

Inside the over 10 years, Competition has developed over 2 hundred online game within the eleven dialects, so it’s perhaps one of the most popular makes worldwide. Their provider boasts all kinds of games, from slots, blackjack and you may poker, so you can keno, bingo and even sudoku. Now it is a great multi-billion dollar industry where only the extremely scrutinised, credible, truthful and you can fair gambling enterprises thrive. Starburst, created by NetEnt, is yet another greatest favorite among online slot professionals. Noted for their brilliant image and you can punctual-paced game play, Starburst also provides a leading RTP out of 96.09percent, rendering it including popular with those individuals searching for constant gains.

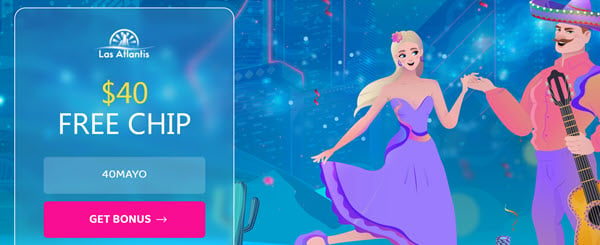

Best On-line casino Coupons & Acceptance Bonuses 2025

Looking for any kind of bonus for alive casino games is actually uncommon as the live options be more expensive currency to perform. That renders a real time casino no deposit promo a true https://vogueplay.com/in/zombie-carnival-pragmatic-play/ treasure and one well worth to experience to have. That it provide was in the way of people no-deposit added bonus, such casino fund, totally free enjoy, otherwise totally free series (according to the type of online game.

After you subscribe Flagman Local casino, you’re also met having a pleasant plan worth up to 1,660 across your first about three deposits. It’s a nice start, nevertheless the terms count, very here’s the brand new description. To ascertain how web site supports today, We subscribed, made a deposit, and you may tested sets from gameplay in order to distributions. But the the truth is one today, there are many more a method to make and you can spend less than just at the any time of all time. Nevertheless should go instead proclaiming that you’ll never spend the lease with the type of sale. Meanwhile, I do believe it’re worthwhile as they can help you build your money-and then make muscle tissue.

This type of treats are available the moment membership is finished. There are also incredible online casino games such Jackpot Jester and therefore provides a huge modern jackpots worth millions. You should keep in mind although not, not the totally free local casino bonuses may be used to your jackpot online casino games, very make sure to investigate gambling establishment conditions and terms very carefully. Slot Container cellular gambling enterprise also provides people a good a hundredpercent around two hundred free welcome incentive.

- For each free twist are cherished in the 0.10, totalling dos.00 for everyone spins.

- Whether or not your’re take a trip, on the a lunch break, or to make dinner at your home, cellular casinos are making a real income betting accessible and you may seamless.

- The original online-hosted percentage options welcome users to get in its mobile count in order to buy something.

- You’ll should be extremely fortunate for many who’re going to meet it betting requirements.

When the gambling enterprise becomes a tad too happy, these types of incentives swoop into conserve a single day. It’s like the casino saying, “Our very own crappy, let us create one up to you,” by letting players recover a portion of your own loss. When it’s free chips or spins worth the same count one tucked because of the hands, a cashback free incentive out of no-deposit casino is actually a bona-fide game-changer. Because the an alternative associate, only register with an online gambling establishment which provides free spins and you can make use of your added bonus immediately. Regular position professionals may access totally free revolves from time to time. In case your gambling enterprise try powering a free revolves campaign, only choose into claim your incentive.

Three pink bubbles usually stand over the reels, and you will choosing one to can tell you certainly one of four additional incentives. These could become many techniques from insane reels, and therefore turn a complete reel insane, in order to a good ‘fairy victory spin’ and that promises a huge successful spin. Furthermore, you can also claim lead entry to your among the incentive function video game. We love to think about these types of no-deposit totally free revolves also provides because the the best way to test an internet site . before carefully deciding to cover your bank account. That way you can sample the fresh game and speak about the new website before opening your own purse. In a way, the brand new now offers may sound too-good to be true because it is actually rare for someone so you can earn a big prize away from a good no-deposit render.

As soon as your cards has been entered, the brand new local casino doesn’t take percentage if you do not authorise it, so you don’t need to bother about the site getting additional finance. As such, you will end up confident that the commission guidance was safer throughout these ports web sites. That have a 7×7 grid and you can a cluster pays mechanic, Fruits Team adds a different dimension so you can position gamble compared to most other games about listing. The casino game organization also have to submit an application for a licence for the United kingdom Gaming Fee.